Book Value Challenge

Book Value tells how much a company is worth based on assets minus liabilities. Book Value Per Share (BVPS) shows how much equity belongs to each shareholder.

How to Play: Solve each question by calculating Book Value Per Share. Click Check Answers to see results instantly.

What Is Book Value?

Book Value represents the company’s net worth based on its balance sheet. It shows how much value remains for shareholders after debts are subtracted from assets.

Book Value Formula:

Book Value = Total Assets – Total Liabilities

Book Value Per Share (BVPS)

BVPS tells you how much of the company’s equity belongs to each individual share.

BVPS Formula:

BVPS = (Assets – Liabilities) ÷ Number of Shares

Why BVPS Matters

- Helps estimate intrinsic value

- Useful for value investing

- Shows whether a stock is undervalued

- Strong BVPS growth indicates wealth creation

This game teaches you how to calculate BVPS using balance sheet data — an essential skill for evaluating company value.

About Book Value Calculation

Book Value tells what remains if a company sold all assets and paid all debts today.

Book Value tells what remains if a company sold all assets and paid all debts today.

BVPS puts that value on a per-share basis, helping investors decide if a stock is undervalued.

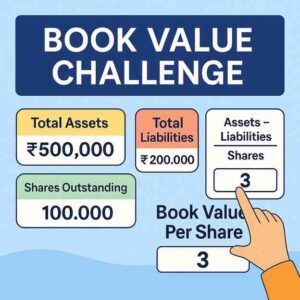

Example:

Assets ₹500,000 – Liabilities ₹200,000 = Book Value ₹300,000

If shares = 100,000 → BVPS = ₹3 per share

This game helps users practice BVPS calculation using simple real-life data.

❓ Frequently Asked Questions (FAQ)

- What does Book Value represent?

It represents the company’s net worth after subtracting liabilities from assets.

- What is Book Value Per Share (BVPS)?

BVPS shows the value of the company’s equity assigned to each share.

- Is higher BVPS better?

Yes — higher BVPS indicates a stronger equity base and potential undervaluation.

- Can BVPS be negative?

Yes. If liabilities exceed assets, BVPS becomes negative — a sign of financial distress.

- Why do value investors care about Book Value?

Because comparing BVPS with stock price can help identify undervalued stocks.

- Is Book Value the same as market value?

No.

Book Value is accounting-based; market value depends on investor demand.

- How is intrinsic value related to Book Value?

BVPS is often the starting point for intrinsic value models like:

- Graham Number

- Net-Net investing

- Asset-based valuation

- Will this game help beginners understand valuation?

Absolutely.

By practicing BVPS calculations, users learn:

- Balance sheet basics

- Equity valuation

- Intrinsic value fundamentals