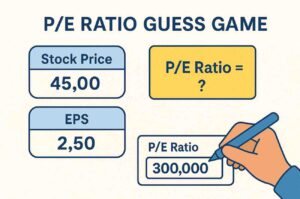

PE Ratio Guess Game

- Exact (within 0.1): +10 points

- Close (within 1.0): +6 points

- Okay (within 2.5): +3 points

- Wrong: 0 points — correct PE shown

Why the PE Ratio Matters

Price-to-Earnings (PE) shows how much investors pay for each rupee of earnings. Lower PE can mean cheap valuation or low growth expectation; higher PE can mean high growth priced in. Use PE alongside other metrics (growth rate, ROE, cash flow) for better decisions.

About PE (Price-to-Earnings)

PE = Price ÷ Earnings Per Share (EPS). It is a quick way to compare how the market values earnings across companies. Use it with growth and cash flow metrics — PE alone does not tell the whole story.

What Is the PE Ratio?

The Price-to-Earnings Ratio (PE Ratio) tells you how much investors are willing to pay for each rupee of earnings a company generates.

The Price-to-Earnings Ratio (PE Ratio) tells you how much investors are willing to pay for each rupee of earnings a company generates.

It is one of the most widely used valuation tools in stock market analysis.

PE Formula:

👉 PE Ratio = Price ÷ EPS (Earnings Per Share)

A high PE often suggests:

- High growth expectations

- Strong investor confidence

- Premium valuation

A low PE may indicate:

- Undervalued stock

- Slowing earnings

- Market pessimism

But PE is meaningful only when compared with:

- Industry averages

- Historical PE of the same company

- Future growth rates

✔ 1. Why the PE Ratio Matters

PE tells you instantly how expensive or cheap a stock is relative to its earnings.

Investors use it to answer questions like:

- Is this stock overvalued or undervalued?

- Are earnings strong enough to justify the price?

- How does this company compare to competitors?

PE helps investors find value stocks or avoid overpriced ones.

✔ 2. How This Game Helps You Learn

The PE Ratio Guess Game gives you:

- A stock price

- Its EPS

- A chance to input the PE guess

- Instant scoring, explanations, and a learning loop

This helps you:

- Build valuation intuition

- Understand how price and EPS interact

- Train your mind to quickly evaluate stocks

- Recognize when a PE seems too high or too low

The game strengthens the foundation of valuation analysis.

✔ 3. Understanding PE More Deeply

There are multiple types of PE ratios:

- Trailing PE

Based on past 12 months earnings (most commonly used).

- Forward PE

Uses projected future earnings — helpful for growth companies.

- Historical PE

Compares current PE with the company’s long-term average.

- Relative PE

Compares PE with competitors or the industry.

This game helps beginners master the core concept before exploring advanced PE variations.

✔ 4. Perfect For Beginners & Investors

This game is especially useful for:

- Students learning financial basics

- Stock market beginners

- Value investors

- Analysts building quick valuation reflexes

PE is one of the fastest ways to evaluate a stock — this game helps you understand it by doing.

❓ Frequently Asked Questions (FAQ)

- What does a high PE ratio mean?

A high PE generally means the stock is expensive compared to earnings.

Investors expect strong future growth.

- What does a low PE ratio mean?

A low PE may indicate a cheap or undervalued stock, but it can also signal:

- Slowing growth

- Weak business fundamentals

- Market concerns

Always analyse deeper before investing.

- What is a good PE ratio?

There is no universal “good PE.”

It depends entirely on:

- Industry

- Company growth rate

- Economic conditions

Tech companies often have high PE; utility companies have low PE.

- How accurate should the PE guess be in the game?

The game accepts guesses with different scoring levels:

- Within 0.1 = Perfect

- Within 1.0 = Great

- Within 2.5 = Acceptable

This helps you build valuation intuition gradually.

- Why does PE become infinite when EPS is zero?

If EPS = 0, dividing price by EPS is impossible — PE becomes undefined (infinite).

This usually means the company made no profit.

- Can PE be negative?

Technically no.

If EPS is negative, PE is not meaningful because the company is losing money.

Analysts simply say:

“The company has negative earnings,”

not

“PE is negative.”

- Should I use PE alone to evaluate a stock?

No. PE must be combined with:

- Growth rate

- ROE / ROCE

- Cash flow

- Industry comparison

- Debt levels

PE is a starting point, not a complete valuation model.

- What skills will I learn from this game?

You will learn:

- How price influences valuation

- How EPS impacts PE

- How to compare stocks quickly

- How to build valuation intuition

These skills are essential for both beginners and experienced investors.