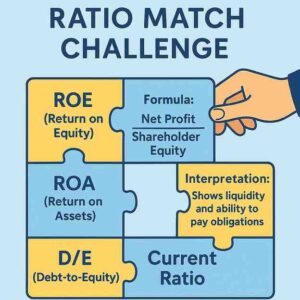

Ratio Match Challenge

Financial ratios help investors understand profitability, efficiency, liquidity and leverage. Learn key ratios such as ROE, ROA, D/E and Current Ratio.

How to Play: Match each ratio with its correct formula and meaning. Click Check Answers to see results instantly.

Ratio Items (Drag Me)

Match Here

Drop correct formula under each ratio label.

Understanding Key Financial Ratios

Financial ratios help investors evaluate profitability, efficiency, liquidity and financial stability.

ROE: Shows how much profit is generated from shareholders' equity.

ROA: Measures how effectively assets are used to generate profits.

D/E Ratio: Indicates leverage and financial risk by comparing debt to equity.

Current Ratio: Shows liquidity and ability to meet short-term obligations.

This game helps beginners understand formulas and meaning behind these essential ratios.

What Are Financial Ratios & Why Are They Important?

Financial ratios help investors evaluate a company’s performance, financial strength, profitability, liquidity, and risk.

Financial ratios help investors evaluate a company’s performance, financial strength, profitability, liquidity, and risk.

They simplify complex financial statements into simple numerical insights that support investment decisions.

The Ratio Match Challenge teaches four essential ratios:

- ROE (Return on Equity) – profitability for shareholders

- ROA (Return on Assets) – efficiency of asset use

- D/E (Debt-to-Equity) – leverage & financial risk

- Current Ratio – liquidity strength

By matching each ratio with its formula and meaning, you understand exactly what each ratio measures and how they are used in stock market analysis.

✔ 1. ROE – Return on Equity

Formula: Net Profit ÷ Shareholder Equity

What it shows:

How efficiently a company generates profit using shareholders’ money.

Higher ROE often means better management performance, but extremely high ROE can also indicate excessive leverage.

✔ 2. ROA – Return on Assets

Formula: Net Profit ÷ Total Assets

What it shows:

How effectively the company uses its assets to produce earnings.

Companies with heavy assets (like manufacturing) generally have lower ROA compared to asset-light businesses (like tech).

✔ 3. Debt-to-Equity Ratio (D/E)

Formula: Total Debt ÷ Shareholder Equity

What it shows:

How much the company relies on borrowed money.

A high D/E ratio indicates higher risk, especially during weak economic phases.

✔ 4. Current Ratio

Formula: Current Assets ÷ Current Liabilities

What it shows:

Whether the company can cover short-term obligations.

A current ratio below 1.0 indicates potential liquidity issues, while very high ratios may signal inefficiency.

🎮 How This Game Helps You Learn

This drag-and-drop matching challenge simplifies financial ratios through interactive learning:

- You match formulas to the correct ratio

- You see explanations for incorrect matches

- You understand the meaning behind each ratio

- You build confidence in reading and analyzing financial statements

This is essential knowledge for anyone learning fundamental analysis, value investing, or financial modeling.

❓ Frequently Asked Questions (FAQ)

- What is the purpose of this Ratio Match Challenge?

The game helps beginners understand how key financial ratios work by matching formulas with the correct ratio.

It builds foundational knowledge needed for stock market investing and company analysis.

- Do I need accounting experience to play this game?

No — the game is designed for complete beginners.

The instant feedback system teaches you step-by-step as you play.

- What skills will I learn from this game?

You will learn:

- How to recognize key profitability and liquidity ratios

- How to link formulas to the correct financial ratio

- How to interpret what each ratio means for a business

- Essential skills for fundamental analysis and stock selection

- What is considered a good ROE or ROA?

It depends on the industry, but generally:

- ROE above 15% is considered strong

- ROA above 8–10% indicates good efficiency

Always compare ratios with companies in the same sector.

- Is a high Debt-to-Equity ratio bad?

Not always — but it indicates the company relies heavily on debt.

High D/E increases financial risk, especially when profits fall or interest rates rise.

- What is a healthy Current Ratio?

A current ratio between 1.2 and 2.0 is generally considered healthy.

Below 1.0 indicates liquidity problems.

- Can these ratios be used for stock market investing?

Absolutely.

Professional investors regularly use ROE, ROA, D/E, and liquidity ratios when analyzing company fundamentals.

- Will more advanced ratio games be available?

Yes! Upcoming games include P/E Ratio Trainer, PEG Ratio Challenge, ROCE Analyzer, and more for StockMaster Games Zone.